Time and time again, history has proven our economy to be better under democratic presidents and, thus Keynesian economic policy. It’s no mystery as to why republican Congresses have been responsible for the last four major economic crisis in the: 1930s, 1970s, 2001, and 2008. Supply-side economics simply doesn’t work in non-Stagflation conditions. As it turns out, lower income tax rates for the wealthy and an increased tax burden for the lower classes doesn’t deliver to middle-class Americans – the driving force behind the economy with the largest MPC.

The phrase “trickle-down” is a misnomer which obfuscates the dire effects the economic policy’s implementation has had on our US economy throughout history. From tripling the national debt, skyrocketing income inequality by solely serving as a transfer of wealth to the top 1% while the middle-class is left behind, and causing a deep recession in 1982 with an unemployment rate of 10.8%. To the Bush tax cuts which raised unemployment to 6%, and finally the failing Kansas trickle-down experiment of 2012 which caused job growth and personal income to lag the US economy. Logically, the President Trump thinks ‘lets do it all over again’ and bankrupt the US economy like one of his casinos by reducing corporate tax rates from 35 to 15 percent.

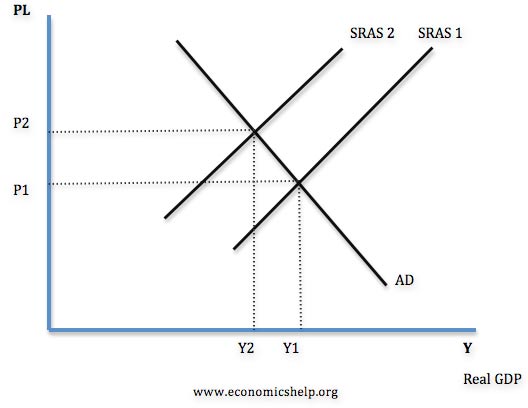

Reaganomics is not effective at growing the economy – just lining the wealthy’s pockets. Yes, Reaganomics pulled the country out of a recession but only because it wasn’t just any recession – it was one marked by high inflation, and unemployment – aka ‘Stagflation.’ This occurs when aggregate supply goes down because there is a shortage of goods due to a supply shock which has caused cost-push inflation. Under such a double-whammy, supply-side economics is the only solution to restoring the economy back to equilibrium. It increases GDP without increasing the price level. However, Reagan’s failure was adding a detrimental twist to supply-side by combining tax cuts for the wealthy with big spending.

But we haven’t experienced such a situation since the ‘70s therefore this economic policy should in way be looked at as precedent or a success story of economic prosperity – it wasn’t and never has been, not for the 99%.

Under our current conditions where aggregate supply exceeds demand, demand-side economics should be enacted to push demand even further to full employment. Although we’re already pretty close, more growth can’t hurt us to the point where we’re needing contractionary policy yet. It’s proven successful with the past three democratic presidents, but it’s important to look back at what doesn’t work and why first.

Although Ronald Reagan did end the left-over Stagflation, it’s by no means proof supply-side is the superior fiscal tool in boosting the US economy. Reaganomics as expansionary fiscal policy simply doesn’t work. As mentioned, it only works during periods of Stagflation to pull the country out of crisis but it does not propel tremendous growth or meet any of Republicans’ promises.

President Reagan’s tax cuts coupled with increased spending in the 1980s turned out to be a disaster. He cut the top tax rate from 70% to 28%, the corporate tax rate from 46-40%, while increase government spending by 2.5% per year, thereby tripling the national debt ($997 billion-$2.85 trillion in 1989.) By not just cutting taxes and lowering spending to run surplus, he created a domino effect of financial crisis. The deficit skyrocketed (because expenditures exceeded revenue by far) which led to inflationary problems such as high interest rates and subsequent low consumer purchasing power. This sparked a recession in 1981 and 1982 with an unemployment rate of 10.8%. High interest rates made the value of a dollar rise and exports decreased.The market eventually balanced itself out, but there’s no shadow of a doubt Reagan’s brand of supply side had dire effects – especially on the middle class.

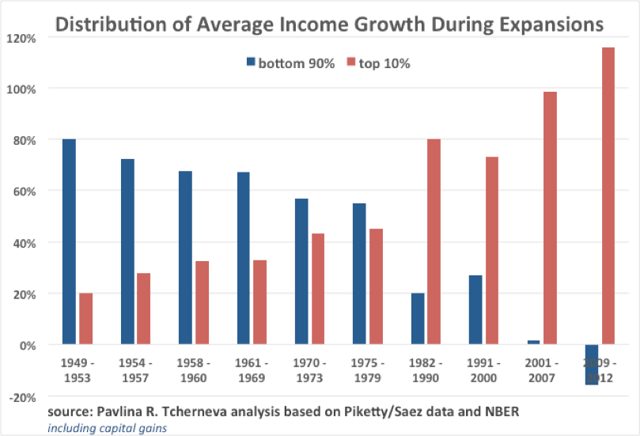

As the consumerist 80s appeared to be outwardly flourishing as a nation, the middle-class trailed behind as income inequality worsened. This was a natural effect of cutting taxes for the wealthy and not for the majority of Americans who happen to have the highest marginal propensity to consume. Economic prosperity trickled up – as the transfer of wealth tax cut was designed to do – and the top 1% saw their income triple.

Why doesn’t the middle-class benefit as promised – why didn’t wealth “trickle-down?” Well because corporations don’t increase hiring or invest more. Tax-dodging corporations such as Verizon, Exxon-Mobil, AT&T had job growth of less than 1% since 2008, compared to 6% for the private sector as a whole, and slashed hundreds of thousands of jobs.

Who knew corporate tax cuts didn’t increase demand and therefore a need for more hiring? It’s astounding how Americans have been tricked into ignoring the basic rules of supply and demand to support the biggest scam. Corporations only hire people when increased demand requires it – when consumption by the middle-class increases, not when they receive massive tax cuts. No amount of tax cuts will increase demand for their goods.

Not only aren’t corporate tax cuts stimulating the economy, but top tax bracket ones aren’t either. As Gordon Gekko explained, the wealthiest earners have a low marginal propensity to consume, they spend 5-10% of their earnings, while the middle and lower classes spend 100-110% of theirs because they have the highest velocity of money/MPC.

The real growth-drivers in America should be the ones receiving tax cuts to increase demand, GDP, and actually incentivize (force) businesses to hire more people. By focusing on policies which allow working and middle-class Americans to have more spending money and increasing human capital through a focus on education we can drive economic growth through the roof. And that vision is precisely what Democratic economic policies are centered around – a vision which has proven time and time again to work.

Not only have Keynesian policies been effective at pulling us out of recessions caused by republicans, but by every important measure, our nation’s economic performance after their implementation outpaces that of the early 1980s.

Bill Clinton managed to become the most successful in terms of economics, out of the past six presidents by increasing taxes by about 8% on the top 5% of households in 1993. Following that, our country gained a surplus of $236 million, cut unemployment in half, and experienced 7 years of vast growth. Of course, this was only possible with a decrease in federal spending. Something that worked then because of the existing inflationary gap which he had to combat by decreasing aggregate demand.

Despite all of this, Wall Street savior Trump wants a rehashing of 1982, of the Bush tax cuts which increased unemployment to 6%, and of the Kansas trickle-down failure. An experiment in wealth redistribution to the wealthy which left the state with an unsustainable billion-dollar deficit, withered services, and general lagging growth rates after taxes were slashed tremendously and business income taxes were completely eliminated. The tax-dodging Con-Artist-in-Chief wants Kansas but on $35 billion dollar border-wall steroids. All while “eliminating” the $19 trillion national debt of course. By slashing the corporate tax rate from 35 to 15 percent he’ll cost the government $2.4 trillion over a decade. How’s that for conservative fiscal policy?

It’s clear that Reaganomics does not work as expansionary fiscal policy and is detrimental to the middle class. A scam that has been packaged as nation-wide prosperity which has many believing giving the rich more money to save is going to somehow increase their economic prospects. Because logic. We haven’t experienced Stagflation since the 1970s but let’s give corporations a tax break because somehow that’s supposed to increase aggregate demand, therefore hiring, and GDP growth fueled by consumerism. Oh wait, that’s what Keynesian policy does.We are to ignore history and ignore basic laws of supply and demand, and that the only way to gracefull employment, is by stimulating demand.

Leave a Reply