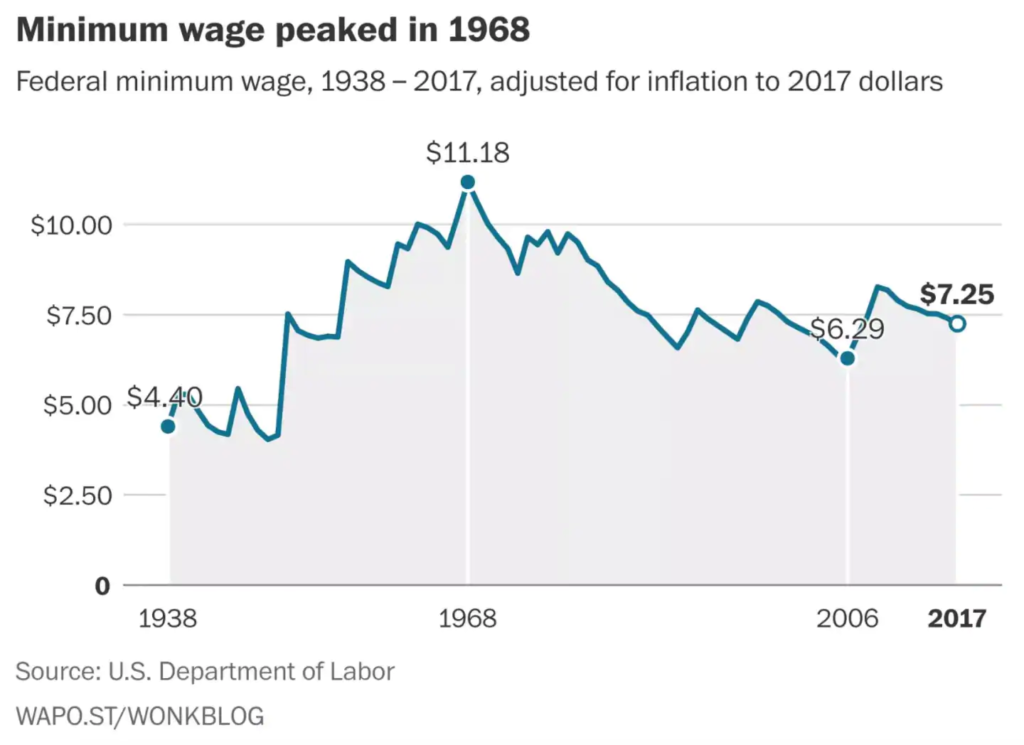

If the federal minimum wage had kept up with the 657% increase in inflation and 176% rise in worker productivity over the past 50 years, it would be $21.72. It peaked in 1968 at $11.18 when the cost of a four-year public university was $329.00, according to National Center for Education Statistics, a manufacturing job bought you a house for $26,600.00, and the cost of living was 657% lower. Net productivity was 77.1% in 1968 while it stood at a record 252.9% in 2018. Economic research has overwhelmingly concluded that a gradual increase to a $15.00 minimum wage would not increase the price level or the unemployment rate. In fact, it would stimulate economic growth through increased consumer demand, business investment and job growth. At a time when income inequality has hit an all time., with 40 million Americans facing hunger, a shocking number of homeless people, and inability of hard-working Americans to achieve socioeconomic advancement in part in the wealthiest country on earth, it’s time to stop the billionaire class from stealing profits from the working-class who has doubled their productivity since the late 1960s. Economists agree that a federal minimum wage increase to $15.00 by 2024 would not cause a rise in the price level or mass job losses. Instead, the spillover effects would cause a strong demand-side stimulus to the economy through an increase in disposable income to the demographic with the highest MPC, and increase middle-wages as well.

Productivity and the Cost of Living Has Skyrocketed But Wages Have Stagnated

Today’s $7.25 minimum wage is 29% less their counterparts made 50 years ago adjusted for inflation despite the fact that productivity has doubled since the late 1960s — CEO’s are literally stealing profit from American workers. The United States has one of the lowest minimum wages of any industrialize democracy in the world. The adjusted value of minimum wage peaked in 1968 at $11.18. According to The Economic Policy Institute , the inflation-adjusted minimum wage has fallen far behind the growth of the economy compared to 50 years ago, when they were virtually equal.

Economic Inequality

Income inequality is at an all time high since the Census Bureau began tracking it, yet we perpetuate the “bootstraps” notion that every hard-working person and child has equality of opportunity — an equal chance to succeed in life. Despite being the wealthiest country on earth, and worker productivity doubling, 12.3% of families continue living in poverty, and 40 million go hungry.

The richest 10% of U.S. households represented 70% of all U.S. wealth in 2018, and the top 1% hold 42.5% of national wealth, a far greater share than in other OECD countries. In no other industrialized nation does the wealthiest 1% own more than 28% of their country’s wealth. Economic inequality in the U.S. ranks higher than in any other wealthy, democratic country, and it has the most poor individuals than any other similar developed nations. Inequality has drastically increased since the 1960s were the top 10 percent of families owned around one-third of the national income, and the top 1 percent received less than 10% of all income . The Gini Index shows that the level of inequality in the United States is almost twice as much as in Sweden and a third more than most other European countries.

Economic inequality has increased since the 1960s due to technology, decline of manufacturing, globalization, and government policies that have not grown the wealth of the middle-class. People without access to the “college wage premium” have seen their earnings decline in this technology age with less manufacturing jobs. Deindustrialization has decreased these well-paying jobs for many Americans and only low-wage jobs have been growing for those who are non-college educated. The stagnated minimum wage has exacerbated this income inequality as the rich continue to reap a higher share of profits produced by the workers.

Spillover Benefits of a $15 min wage: Demand-side Economic Growth, Middle-Wage Increases, and Reduced Taxpyaer Spending on Assistance Programs

According to the Economic Policy Institute, $15 minimum wage by 2024 would result in $121 billion in higher wages for almost 41 million low-wage workers thereby providing a positive multiplier effect to the economy through the raise in disposable income of the demographic with the highest MPC. This demographic would stimulate consumer demand, business activity, and job growth. The increase would be indexed to growth in median wages, thereby securing that the wage floor keeps pace with growth of middle-wage workers in the future.

A $15.00 minimum wage would directly affect 28.1 million workers by 2024 and another 11.6 million workers whose wages are just above the new minimum wage through “spillover” effects as employers adjust their scales.

Liberal economists agree that a minimum wage raise will stimulate the economy and reduce taxpayer spending on assistance programs.

The Price Level Would Not Rise

Two years after Seattle raised its minimum wage to $15.00, a study found no significant evidence of price level increases associated with the minimum wage law.

The researchers analyzed prices for 106 food articles from six supermarket chain stores in Seattle and in six of the same-chain stores in King County unaffected by the ordinance. The price check occurred at four time points: one month pre, one month post, one year post, and two years post ordinance implementation.

Effects in Employment: Modest Increases — No Job Loses

Although some conservatives estimate that raising the federal minimum wage to $15 an hour by 2024 would put 1.3 million Americans out of work (CBO), minimum wage hikes in states and cities in recent years give us actual quantitative data on the effects of wage floor increases

Economics at UCLA examined the effect of the statewide minimum wage rise in California from $6.75 in 2006 to $10.50 in 2017 (slated to hit $15 in 2022), and focused on the restaurant industry. They estimated that, “the increments in the minimum wage..were estimated to increase earnings in limited service restaurants slightly more than 10% but reduced employment by about 12%.” And that the rise up to $10.50 by 2017 raised earnings in those restaurants by another 20%, but reduced employment by another 10%..

Polar opposite to these findings, a U.C. Berkeley study looked at the effects of city-level minimum wage hikes in recent years. It compared the cities of Chicago, Los Angeles, Oakland, San Francisco, San Jose, Seattle and Washington, to economically-comparable nearby ones. The paper found that wages were up while changes to employment were minimal: “We find significantly positive effects on wages and small effects on employment, consistent with many previous studies.”

Furthermore, a high-profile paper by David Card and Alan Krueger proved what many economists have agreed on — modest increases to wage minimums don’t cause huge job losses. “Many studies have found little or no effect of minimum wages on employment, but many others have found substantial reductions in employment (CBO).”

Leave a Reply